Dear reader:

We are happy to present you herewith the first issue of our newsletter (downloadable version).

We publish the newsletter in (mainly) monthly intervals to address specific topics which we think could (and should) be of interest to you. They are always somewhat related to our core investment principles set out in “The 10 Commandments for the Intelligent Investor in the 21st Century” and the “Bernstein Long-Term Trends”.

In the latter you may miss a view on the emergence of so-called cryptocurrencies, like Bitcoin, Etherum, etc. This is a heavily discussed topic. Even Mr Buffett and Mr Munger spent time on it during the last Berkshire Hathaway shareholder meeting. Mr Munger compared cryptocurrency investors to the biblical figure of Judas Iscariot and trading them as “just dementia”. Mr Buffett called it a “gambling device” and a stage of fraudsters and charlatans.

These are quite emotional statements and - in contrast to investing in gold, on which Buffett has written an excellent essay in 2012 - not backed up by much fundamental insight.

We have tried to undertake this effort of fundamental analysis first by submitting a set of questions and answers on crypto currencies. If you already know their inner workings you may skip sections 1 to 7 and start with the economic and financial analysis set forth in section 8 to 10. So here we are:

***

Ten Questions and Answers on Crypto Currencies

1. What are cryptocurrencies?

In simple words, e.g. one bitcoin represents a share in a decentralized (no central bank), computer-generated (nothing physical) and rule-based (assuring it can be spent only once) pool of “value” of a pre-defined, limited size. The algorithms governing that pool allow for two things: establish accounts to hold the cryptocurrency and a mechanism (the blockchain) to effect and verify transfers from one account to another.

You can imagine it as a virtual tree which keeps growing up to its maximum height throwing off a non-perishable fruit which can be exchanged against “real” money or other goods. This image allows also to answer another question: who grows the tree and hence its fruit?

It is simple: The people who nourish that tree, the so-called “miners”, get the first call on each new fruit they have helped to grow. They also get a slice of the fruit for transferring it from one person to the other...

2. What are they good for?

Like anything else you spend money on, cryptocurrencies have to serve a purpose. There are just two (yet important) ones: make payments and store value. “Normal” money has the same simple purposes. In essence that is also the beginning and the end of their application. Buying them is simply swapping one currency against another.

3. Are cryptocurrencies a “better” type of money?

The answer requires a look at the two existing alternatives: a) real cash b) account or “plastic” money. Like real cash, payments with crypto is essentially anonymous. Larger payments with real cash are virtually impossible these days, both in terms of physical size and government controls (see below). In this respect crypto clearly beats cash and is therefore frequently used for payments on the dark web.

Compared to plastic money it offers (theoretically) far lower transaction costs and overall and quicker, easier execution. That is theory, though. The reality looks different (see below).

Setting aside the issue of actual usefulness and security (see hereafter) it could be a sort of “better” money.

4. Are cryptocurrencies safe?

Crypto is stored in so-called “wallets”, which are password-protected and encrypted computer-based “accounts”, set up and directly managed by each user. These “accounts” can be held in “hot” storage, i.e. can be accessed via the Internet - or “cold” storage, i.e. removable hard disks or USB sticks.

Hot storage can be compared to your online banking or credit card account, cold storage is like cash in your wallet.

The security profile of crypto in this respect is not in any way different from their old-school equivalents. Online account can be hacked or accessed through “phishing”. Wallets with cash can be lost or stolen, as can be hard disks and USB sticks.

In the end of the day ultimate security depends on the care (or the carelessness for that matter) of the holder. The key difference is that in case of bank accounts, the bank itself has a big stake in the game of making your money secure. As regards to crypto, the decentralized “system” running it does not care about individual losses - as long as the overall integrity of the respective cryptocurrency is not at stake. The inherently open nature of crypto makes it nevertheless prone to public hacking attacks - widely publicized in the press, once and when they happen in a meaningful size.

However, overall crypto is as safe as you make it yourself by selecting and protecting your wallet and its content!

5. Who controls cryptocurrencies?

No single person nor institution controls them. The only control is the “public eye” of the Internet combined with the belief that the underlying algorithms assure the integrity (no falsification, no double-spending, safety of storage) of the currency. The occurrence of a “better” (or at least alternative) form of money is obviously a thorn in the eye of its current monopoly suppliers, I.e. governments and central banks.

Cryptocurrencies are effectively banned in China, Russia and a few other countries. Most developed nations have taken a “neutral” or no position yet. They focus instead on controlling the exchange of crypto into “real” or so-called “fiat” currencies.

The still negligible size of cryptocurrencies compared to the vast pool of cash and plastic money creates no real threat to their monopolies - yet. That could change quickly. Then, with a simple stroke of legislation (e.g. declaring the use or conversion of crypto as wire fraud or plain illegal) the incumbent monopolies would crash the demand and hence the price of cryptocurrencies. But:

6. What determines the “price” of cryptocurrencies?

On the surface, it is simple - like with any other market-traded “good”, prices for crypto are determined by supply and demand. There is no “central bank” affecting (or frequently distorting) the price by a) managing the supply and b) setting interest rates on holdings.

Demand is made up of three components:

a) holding crypto for the purpose of effecting payments

b) holding it (medium-term) as a store of value and

c) purely speculative demand.

The latter group will – with a high probability approaching certainty - hold the cryptocurrencies only as long as prices are expected to go up (further) and will drop them like hot potatoes in a panic stampede should the market start collapsing (see later bubble risk).

There is no solid data available on the breakdown between a) to c). Our gut feeling right now is that c) is by far the biggest factor of demand. The wild price swings of the past can be easily attributed to just that factor. There is more detail on this issue below.

The supply side can be explained by referring back to the image of the tree 🌳 used above. The “miners” nurture it and get the fruit they are growing. (Technically the nurturing is done by solving increasingly calculation-intensive mathematical tasks. The “miners” will only grow more fruit if the marginal costs of doing so - computer power, electricity -are not higher than the price of the respective crypto).

As such, there is a system-inherent, automatic and price-driven control of supply (again in contrast to central bank committees of a few individuals, heavily influenced by politicians).

7. Where can you make payments with cryptocurrencies?

It is a well-known fact that due its anonymous, unregulated and scalable features cyber cash has been used extensively for making payments for the purchase of illicit goods on the dark web.

In the world of ordinary commerce the adoption rate is still negligible. There are a bunch of online shopping sites; Microsoft accepts it for some of its gaming products; Famsa, a Mexican (sic!) online retailer accepts it; Amazon has never accepted it and despite working with blockchain technology has no plans to do so.

The BTC market cap as of this writing is about USD 130 billion. Given the amount and size of respectable retailers accepting it, the number of users holding their bitcoin for payment purposes (see above) seems to be rather negligible.

Will that change in the future? It’s a classical chicken and egg problem - if retailers do not accept it, no need to hold it. If people do not hold it to pay with it, no need to accept it.

Given the accessibility and easiness of using e.g. ApplePay (with costs mainly absorbed by the merchants and not the consumer) and the still cumbersome features of most mobile crypto wallets it is hard to see any real pick-up in fundamental demand for legal payment services via crypto.

The only driver for a real change would be a stronger interest of merchants to reduce their share and the overall costs of payment processing by pushing the “theoretical” crypto-efficiency compared to credit card or alternative payments (PayPal etc.) to reduce costs in the system.

8. Is crypto a good store of value?

Given its limited current use as a mean for effecting payments one has to look at its potential as a storage for value. The driver behind that is the extremely generous supply of low or no interest cash by the central banks which will devaluate (at least over time) existing currencies by way of inflation. It is quite a logical thought: if the supply of crypto is limited and the amount of normal cash in circulation increases substantially, the relative value of crypto should increase. This is further analyzed below in the context of valuing crypto currencies.

This does however also hold true for other inflation-protected assets like real estate, shares in companies or as another example: gold. As such, the usefulness of crypto in this respect has to be compared against available alternatives: real estate and companies provide returns (rent income, profits, dividends); gold and crypto provide: nothing.

Since crypto (even ignoring its current extreme volatility) does not provide any real advantage as a means of payment nor in terms of value storage, the next question is:

9. What drives the push into cryptocurrencies??

The current push comes from two sides:

a) a libertarian movement against government control and

b) existing holders interested in convincing new buyers to enter the market and push up the price.

Cryptocurrencies are anonymous and in itself beyond government control. This appeals to the free-market, free-society and free-everything folks. There is nothing wrong in that. Government interference has reached an unprecedented level around the world. Having (a yet small) corrective against it and putting discipline on monetary expansion and budget deficitism has something to it.

The problem starts when cryptocurrencies are pushed as part of “get rich quick” and become a millionaire overnight” rhetoric. As with any speculative bubble in financial history it will potentially make some people rich, i.e. those who get in early and out early enough. The issue is that “the devil takes the hindmost” (see also the book with the same title by Edward Chancellor, an insightful history of financial speculation from early modern times to the end of the 20th century – see Amazon link).

When a herd of “investors” moves into one direction pushing up the price of something far, far beyond its fundamental value (defined by its use and purpose, both in itself and compared to possible alternatives) matters become ugly - eventually. This has been the case with the price of tulips in the Amsterdam of the 17th century and Internet stocks in the bubble of 2000. The bloodbath starts when somebody cries: “The emperor has no clothing on” and everybody suddenly runs for the exit.

This leads to the tenth and final question:

10. Is it advisable to “invest” in cryptocurrencies??

We could take the following view: by buying cryptocurrencies now you acquire a stake in an emerging, independent virtual “bank” offering decentralized account holding/management, money transfer/payment and value storage services. The more people will use the “services” of that “bank”, the more valuable your initial stake becomes. That’s what an investment decision could be fundamentally about. This is no different from Mr Buffett and Mr Munger investing in Wells Fargo or Bank of America.

The question then finally boils down to the following: at current prices, is buying a “stake” in those banks financially worth your while? The ensuing analysis should takes the high-flying emotions (see above) out of that topic.

For the sake of simplicity, we will do the analysis based on bitcoin, by far the biggest cryptocurrency per today.

That analysis has to address the following issues:

• How much of the current market cap of USD 130bn is held for actual payment purposes?

• How much is held for bona-fide value storage?

• How much is held for mere short-term speculative purposes?

Based on data from 2018, real commerce transactions in BTC amounted to USD 60m to USD 100m per month. Assume hence it is USD 1bn a year. Assuming further that people hold about three to four times their current spending on account that implies a number of USD 3-4bn.

Due to its remarkable price volatility BTC is not a good traditional store of value - as prices may go up but also can fall 50% or more over a few days or weeks. Further, most data suggest that the vast majority of transactions and holdings are driven merely for speculative purposes (see e.g Global Cryptocurrency Benchmarking Study5). As both an optimistic and conservative estimate let’s assume another 15% of the market cap is genuine value storage (we believe it is far less).

That means overall USD 20bn is a somewhat stable investment similar to deposits in a normal bank.

Any bank would be able to lever that money with a 10% equity ratio. As the vast majority of banks trade around book value, a generous multiple of 1.5x (reflecting the growth potential) would imply an equity value of USD 3bn as a business value for the bitcoin operation as such. Combined with the estimated stable deposits of USD 20bn that sum of USD 23bn (entity value) is a mere 18% of the current BTC market cap.

As a result, unless the share of actual payment and of genuine value storage holdings in the respective virtual bank can be increased, the current price of BTC has at least an 80% downside potential.

Another way to look at valuation is to compare the relative increase in size of central bank money to the pool of bitcoins outstanding. As mentioned above, if the central banks expand money supply by a higher rate than the amounts of bitcoins outstanding the relative value of the latter should increase.

Since its inception at the beginning of 2009 the amount of BTC in circulation has increased from zero to slightly above 17.7mn per 17 May 2019. For the purpose of our analysis we start in 2011 when one BTC reached parity with the USD, i.e. one bitcoin = one dollar.

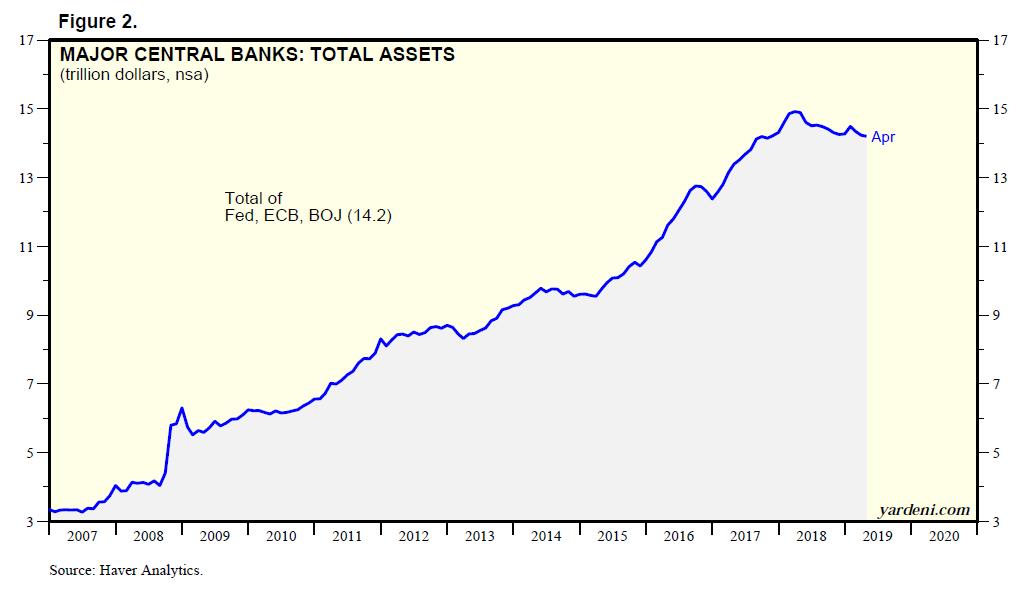

The following chart outlines the parallel expansion of the balance sheets (broadly equivalent to money supply) of the world’s three major central banks (Fed, BofJ and ECB):

From the beginning of 2011 the supply has more than doubled from USD 7tn to slightly below USD 15tn at the beginning of 2019. For the sake of completeness, the balance sheet of the Bank of China has expanded in a similar fashion.

During the same period, the supply of BTC has increased from 5m on 1 January 2011 to the already mentioned 17.7m as of today. That is an increase of more than three times. Over the same interval, the price has increased from the referenced starting point of USD 1 to approx. USD 8,100 today, having reached an all-time high of above USD 20.000 in 2017.

As a result, the “value” pool represented by BTC has increased from USD 5m at the beginning of 2011 to more than USD 130bn as of today.

It pops to the reader’s eye immediately that the supply of BTC has increased three times more than central bank supply, the price has increase by a factor of 8,000x. This can in no way be explained by the catch-up /rebalancing in respect to the relative increases in supply. Based on that measure one BTC should trade at around 60 cents.

Accordingly, the only justifiable valuation approach is to look at BTC as a virtual bank along the lines presented above. But even that standard suggests an 80% over-valuation based on current prices.

________

5 Cambridge Center for Alternative Finance, Hileman/Rauchs, 2017

***

As as result, is absolutely and clearly not advisable to convert any more money into BTC (or any other cryptocurrency) than you may need for effecting any payments due within a short period of time at the current prices.

As as result, is absolutely and clearly not advisable to convert any more money into BTC (or any other cryptocurrency) than you may need for effecting any payments due within a short period of time at the current prices.

In summary:

• in theory a better “money”, in practice (costs, transfer times, handling) worse

• not advisable as value storage (volatility) as there are better alternatives (real estate, stocks, even physical gold)

• 80%+ overvalued currently even when setting generous terms for analyzing fundamentals

Thanks for reading thus far. It has become a long letter. Future ones will be shorter. But we hope it was worth your while as we now have a basic framework to access cryptocurrencies (as any other investment) from a fundamental perspective. We will not be the hindmost and the devil will not take us!

We can set aside the emotions and guesswork and focus again on our long-term investment strategy. We are more confident than ever that this is the right way going forward.

Yours sincerely,

Markus Felix Schauerte

BernsteinVIP