The structured life-cycle approach to investing

Diversified Investments & Averaging

How, when and where to invest

Asset Allocation

The term refers to the question how, when and where to invest and is less complicated than most people want you to believe. Based on the important distinction between regular and one-off investments Bernstein demonstrates that most answers can be provided by a simple, structured life-cycle approach to investing.

Regular Investments

Building a reasonable amount of capital from monthly savings is inherently long-term and driven by the benefit of compounding. Since equities and bonds with high real interest rates offer the best expected long-term gains they are the only relevant asset allocation choice. Price-averaging rather than market timing, e.g. through tactical = short-term allocation switches, is the best way to ride out market swings. High costs over the years eat tremendously into returns – an area frequently and intentionally avoided by fee-driven investment advisors.

One-Off Investments

Capital protection is absolutely key when you have acquired a substantial amount of cash to invest. Low risk, low return strategies are however subject to significant capital erosion by inflation. Ways to avoid that are illustrated as well as a simple rule-of-thumb allocation model in case you want to maintain direct control over a reasonable part of your assets. Pitfalls when choosing advisors are high-lighted.

The search for answers to the question how, when and where to invest, represents the essence of the term “asset allocation”, commonly used in investment speak. Financial advisors of any type perceive their ability to provide those answers, reflecting on the individual circumstances of the investor, as a key component of their value added.

Supported by ample “scientific” research and literature on the topic, they like to obscure and overcomplicate it in order to instill the feeling of need in the investor for (directly or indirectly) paid advice. At the same time, there is a new breed of online-based asset allocation service providers who - based on standardized input variables - come up with a bunch of pretty pie-charts outlining which asset classes you should favor and when to switch.

Notwithstanding the above, asset allocation is also in our view a key factor in overall portfolio performance. We believe however that most answers are actually quite straightforward and can be derived from a relatively simple, structured life cycle approach which we present hereafter.

Regular versus One-Off Investments

A key distinction to be made at the very beginning is whether you analyze asset allocation in respect to a) regular (usually monthly) savings in smaller amounts or b) larger one-off sums, received e.g. by way of inheritance, sale of a private company, lottery winnings, etc. Whereas some principles can and need to be applied consistently to both scenarios, the asset allocation question also needs to cover different angles. We will illustrate these principles first as regards to regular investments and then outline differences as they apply to one-off investments.

1. Regular Investments - the Basics

Let’s hence focus first on regular investments. The money to fund those usually comes from a residual part of the investor’s monthly income, typically salaries, which are left after paying for the indispensable items of daily life. This includes obviously the pay-down of student loans, which represents a high initial burden on most individuals entering into better-paid jobs. It has to be said that a vast majority of the population, simply based on their salaries, are unable to save and hence invest, and therefore asset allocation is of no relevance to them. Usually they are restricted, by way of mandatory deductions, to “invest” in public pension schemes.

2. Rent or Buy Real Estate

If the individual is hence disposing of spare funds, usually the very first fundamental decision to make is whether to buy real estate for use as a primary residence. We are not going to discuss if this makes sense or not fundamentally or psychologically, a positive answer to this simply further restricts the ability to invest in other opportunities. (From a mere monetary perspective a rent or buy decision regarding a personal dwelling is determined by just a few factors, which we discuss in a separate setting “Rent or buy – a simple monetary analysis”.

3. Emergency Funds or Cash Holdings

In case there is money available to invest after having settled the real estate question, people usually focus their immediate attention on how much they should keep in cash or very liquid securities to cover emergencies of any type. We do not hold out ourselves as specialists on that topic but volunteer a rule of thumb: keep 12-24 months of your net salary in a very liquid emergency fund. Even if you lose your job, go through a divorce or face costly uncovered medical issues, a period of one to two years should be enough time to reorganize your life and start earning again.

4. Understanding the Purpose and Timing of an Investment

Most frequently and most reasonably, the purpose of regular savings is to accumulate a) a nest egg to fund one’s retirement or b) a down-payment for buying a major asset, e.g. real estate (see above), a yacht, a vintage car or other desirable items.

Why does this matter from an asset allocation perspective? The answer is timing. Over a short period of time the ratio between a) the principal amount (i.e. the money that you actually paid for the investment and simply want it back at 100%) and b) the accrued interest, even at comparatively high rates, is high. As such, on investments with less than five years to maturity, principal protection is the key priority. If your principal goes down 25% you need an annualized yield of 5.92% simply to break even.

As such, if you need the money back within five years or less do not even bother to worry about asset allocation. Invest your money in highly rated short-term paper and/or bonds with a maximum maturity in line with your anticipated investment horizon until you draw down the funds.

On the other hand, if your investment horizon extends significantly beyond five years and we are talking about a continuous saving and investment process until retirement, the ratio between principal returned and accrued yields is much lower. And this ratio is simply influenced and further improved a) by the expected implied yield of your investments and b) the associated costs related thereto.

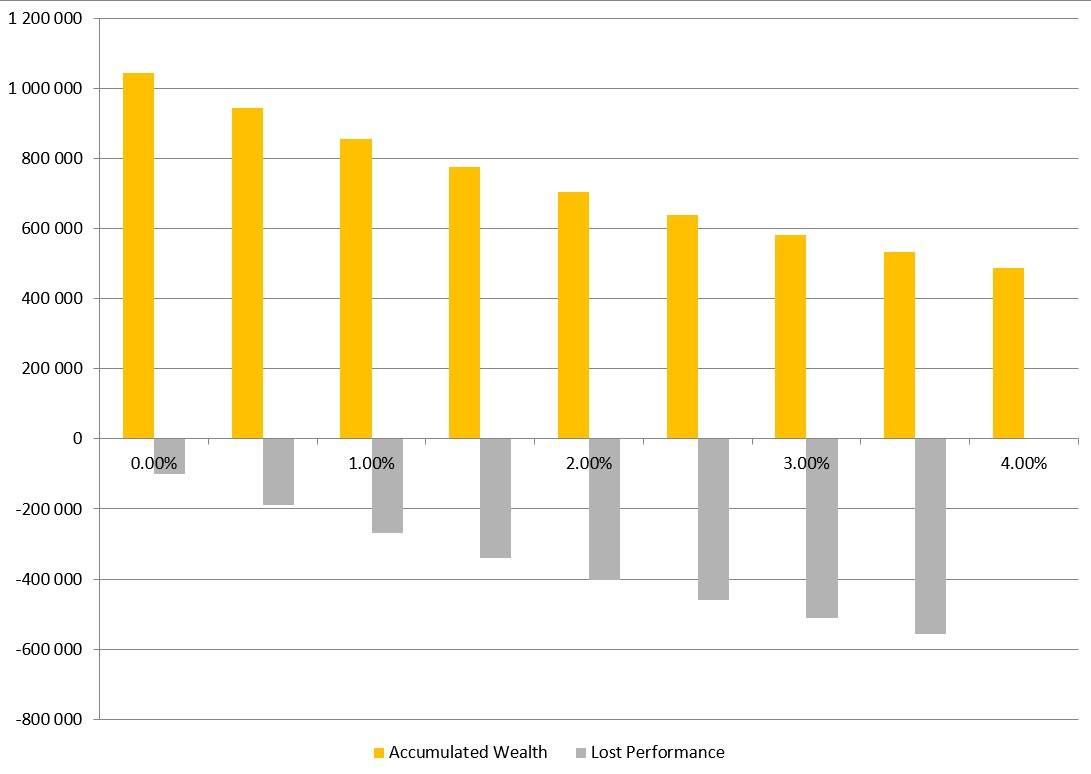

The following graph outlines this issue:

Explanation: Using our standard sample of $700 invested monthly over a 30 year period at an annual yield of 8%, the maximum result of above $1mn decreases significantly the higher the annual cost. Taken a quite usual 2,5% for private banking clients the net result will be a mere $638,528, a net difference of more than $400,000

The usual bells and whistles of your investment advisor can hence be boiled down to two essential guidelines:

-

Allocate all your savings to the asset class with the highest expected long-term inflation adjusted yields. All evidence suggests that this will be a) equities and b) bonds purchased during times of comparatively high real and nominal interest rates.

-

Minimize the annualized costs of holding and managing your investments. Due to compounding effects, 1% additional costs reduce the return on each invested $ by 22% and 35% over a 20 year or 30 year period, respectively.

Which brings us to our conclusion to the asset allocation question for regular monthly investments:

-

If your investment horizon is short the only relevant determinant is principal protection

-

If your investment horizon is long your best choice are equities and bonds with high real yields.

5. Income versus Capital Appreciation

Another issue that features high in any “high-level” asset allocation discussion is the split between income producing securities versus capital appreciation or growth stocks. It is however completely irrelevant in the context of a regular monthly investment process. If you need a certain amount of regular income, you can effectively save = invest less. Why bother putting money into a portfolio and then take it out as “income”?

One-Off Investments

This question is however relevant when you happen to receive a large amount of cash through some fortunate event and plan to invest it. As such we will focus on this scenario hereafter:

1. One-Off Investments - the Basics

It may happen to some of us that by way of a major “cash event” we find our current bank account stuffed to the limit with liquidity starting to burn a hole in our pocket. Before celebrating and itching too much don’t forget the difference between gross and net - and expect the taxman (in the absence of any applied withholding tax) to ask for a significant chunk of it after next year’s tax filing. (For a brief overview on our take on taxes & investment click here.

In any case, a nice sum should be left at your disposal. As with regular investments you will look into the question whether, now that you got the cash, buy a new or better principal residence or vacation properties and anything that comes with it, be it yachts, sports cars, high-end music chains, jewellery, etc. Any you may want to stash some cash away for emergencies or impulse purchases (if you get the punt).

After making the various “deductions” set forth above, you know what you got and now have to decide what you want out of it. And this brings you right to the core of the asset allocation questions, i.e. how, when and where to invest.

2. Purpose and Timing of One-Off Investments

In contrast to the regular, long-term saver who wants to build wealth, you already got it. The sad truth is though that a large quantity of lucky individuals who build a fortune through their entrepreneurial activities, i.e. by being active, lose a large chunk if not all of it when they invest passively over time. (Passive in this context means that they either entrust their funds to third parties for handling or become private equity / venture capital investors, making non-controlling investments in company they like and believe in but do not manage themselves.)

With this in mind, we encourage investors looking to making one-off investment to refer to our so-called Ten Commandments, the first one of which states simply: “Capital protection and eventual full return is the highest priority”.

Capital erodes fastest by a) generating negative inflation-adjusted returns b) allocating too large amounts to undiversified investments which can implode in value all the way to zero, i.e. growth stocks with no tangible assets, over-leveraged companies or government bonds of nations with a history of defaults and c) leveraged, speculative bets on market directions.

By applying the nine additional principles we are very confident that you will be able to maintain and for sure grow your capital, since they stay away from the main areas of capital erosion.

If your capital for a one-off investment is large enough, you will be able to live off dividend and interest income of that strategy driven - by the 10 Commandments - comfortably, frequently without touching the principal. It also avoids the tendency to gamble, which is evidenced by the mind-set of “easy come, easy go”.

By allocating assets to first and foremost to protect capital and second to generate positive long-term inflation adjusted returns you are free to define any purpose for the use of both the income as well as the accumulated principal over the years, be it supporting your children and other family, charitable activities, sponsoring, the establishment of a collection of art, vintage cars or anything else you might be interested in.

3. Asset Allocation and Advisors

Given the slightest degree of public knowledge of your newly acquired fortune you will undoubtedly be approached by many advisors who volunteer in helping you to invest your money. If your fortune is large enough, you will furthermore encounter advisors on how to select other advisors further down the food-chain. Private banks and multi-family offices usually offer comprehensive, integrated services which also covers their take on asset allocation.

The vast majority of those are honest and well-meaning individuals. Just keep in mind that they are not doing it for free and that each additional layer sucks off the return from the underlying assets (see here for a certainly somewhat polemic introduction to the topic Bernstein Asset Advisory.

Each of them will (unless they are dedicated to just one asset class, specialists so to speak) get the overall mandate of handling your funds. Your intuitive reaction should (and will be) that this would be a little one-sided and ignore the time-tested principle of diversification.

We would put forward for you to judge the following basis allocation strategy: a) keep about 25% for yourself and invest it in a self-directed brokerage account buying shares in companies you know and like; if in doubt by low-cost ETFs on the S&P500 or any other major index in your home country b) invest 25% in diversified, low-cost bond ETFs providing stable annual interest income c) invest 25% either directly in income-producing real estate or REITs, if you prefer liquid securities d) select a low-cost, long-term oriented alternative investment manager whose strategy convinces you that it will generate attractive returns through the market cycles. For that final part it would be worth to have a look at the Bernstein Value & Income Portfolio.

You may miss any discussion of investments in precious metals or natural resources. We believe that if you like to get exposure to positive market developments in these areas, it is much better - rather than investing into the zero-yielding assets themselves – to invest in the producers and processors of these (compare the sixth of our Commandments).

4. Asset Allocation and Timing

Mirroring the benefits of a regular, disciplined monthly investment strategy, we believe it would be common sense, whatever asset allocation model you choose, to move into equities or bonds with a longer maturity in increments. We believe that it should be at least over two years up to five years. You never know when a market has peaked and what set of unexpected circumstances could trigger a major downward correction. Given the market cycles, history has shown that if you go all-in at the wrong moment it will take you far longer to recover compared to a strategy where you average into the market.

So in addition to the simple principles for asset allocation for regular investments we can distill the following simple principles for the asset allocation of one-off investments:

-

Allocate conservatively to protect your capital and avoid allocations to highly capital-erosive asset classes if things go wrong

-

Select assets which provide an intrinsic protection against inflation

-

Allocation thru layers of advisors and other middlemen sucks off a lot of potential yield

-

Keep a sizeable part of your funds under your own control and if in doubt allocate to index-type share and bond ETFs

-

Allocate a sizeable part to real estate

-

Select one or two alternative investment managers with a clearly defined long-term strategy

This is our current thinking. Please feel free to share your own view with us either by posting in our forum or by writing directly to our Managing Partners at management@bernsteintrust.com