For us, investing is always co-investing … we like to see ourselves as partners of our investors, and vice-versa …

Invest

Transparency, reporting, monitoring, communication = max. / bureaucracy = min.

Long-term: principled, …

The Bernstein Value & Income Portfolio is managed using time-tested principles of value investing (Graham, Buffett) in combination with hedging and yield enhancing instruments within a disciplined, long-term oriented framwork …

performing, partnering

The actual investment in the BVIP is via transferable certificates with a current unit value of EUR 515.77 as per August, 2023. Accordingly, we can flexibly accommodate both private and institutional investors. The subscription is straightforward, for full details see below ...

Short-term: protected, …

AI-CDC investments are held in segregated accounts at Toronto Dominion Bank Group. Each certificate represents a nominal share of EUR/USD 1.000 + accrued interest. The deposits are protected up to x by the Canadian government ...

flexible, shared benefits

Duration of the AI-CDC paper is from 1 to 12 months. Key benefit - in addition to attractive ordinary interest - is an accumulating bonus interest on each prolon-gation. Subscription, payment, verification can all be handled online - see below for more ...

Long-term investment partnership - Bernstein Value & Income Portfolio

In the same boat …

We are having a substantial part of our own net worth in the BVIP. Protecting our joint capital at all times is hence top priority. We are in this for the long-term and see ourselves in a true partnership with our investors.

We are targeting an 8% average return @less volatility than S&P 500

We have been investing our own funds following the investment principles of the BVIP since 2011, consistently generating yields of 10% and above. The hurdle rate of the BVIP is 8%. Our 2015 return was 8.8% (after deducting 0.4% fees and a 20% carry)

How do we plan to invest jointly?

Long-term

Interested investors are encouraged and should feel free to test and implement the principles laid down in the "Ten Commandments for the Intelligent Investor for the 21st Century" themselves and become successful long-term investors (rather than mere Speculators) on their own. Implementing all the elements is not entirely trivial but it can be done, so we would congratulate you to such a move.

Disciplined

Investors who prefer to benefit directly from applying our investment principles should join us as investors in the Bernstein Value & Income Portfolio (“BVIP”). The investments can be either effected as one-off payments or (resonating well with a cornerstone of our investment philosophy) monthly investment contributions. (For details on the straightforward technical & legal implementation click on the link Legal & Other below)

Full buy-in

What we are looking for is a long-term investment partnership with likeminded people and institutions. That means we are in the same boat as you, continuing to allocate a major part of our liquid assets to the BVIP.

How do we benefit?

Carry of 20% above 8% hurdle rate

There is only one way in which we are different as investors than you: 20% of any returns on the funds invested in the BVIP exceeding the hurdle rate of 8% per annum, calculated over a five year period, will accrue to us. We will receive neither an annual management fee nor any other compensation for managing the BVIP. Please check additional information and sample calculations on this approach here: "Allocation of profits & costs"

Beating the crowds

Our main motivation though is getting more people out of the costly, non-transparent and hypocrite world of private banking, out of ill-advised mutual fund investments, out of commission-driven brokerage accounts or out of mispriced derivative investments.

What to expect and …

Healthy sleep

You should know that luckily we are financially ok on our own and do not want to lose our healthy sleep over the status of our joint investments. Accordingly, to make you a happy and content investor in the BVIP, we would like to outline some important elements in our approach which hopefully you feel comfortable with. If not, we hope you have enjoyed reading thus far, if yes, we are sure that we remain on the same page for a long, long time!"

Direct contact

Felix, although personally not too keen to appear in public, has nonetheless happily agreed to be your immediate and direct contact when establishing our investment relationship. Dmitri prefers to stay in the background, having laid the groundwork for many of Bernstein’s investment principles and will continue to monitor and implement them in the management of the BVIP.

Regular, professional reporting

We will report to you comprehensively on a quarterly basis on the performance and net asset value of the BVIP. Once a year we will organize an investor’s meeting in Frankfurt am Main where we discuss the full annual reports of the BVIP, its core holdings, our plans for the future and any adjustments of our strategy, our successes and our failures and any other topics you as an investor will be interested in.

… not to expect from us

Regulation, bureaucracy

You should note that we want Bernstein and the BVIP to remain private, unregulated investment vehicles for the long-term. We do not want to spoil our lives by the constant scrutiny of a public company and spending our days with reports and compliance. At the same time, we will report the relevant information to you as an investor, in a timely, most comprehensive and professional manner.

Panic & short-termism

This will also (hopefully not, but most likely it will) include periods of underperformance with mixed or even negative results. If an essential part of our investment strategy is holding equity for the long-term, a serious bear market will certainly hit us. By continuing to invest and use our liquid funds to increase our positions in attractive companies will pay off handsomely at some time thereafter.

Hoarding cash, avoiding distributions

We believe that generating and then also distributing investment income as dividends on a yearly basis increases the attractiveness of the BVIP for many investors. As such we plan to pay out an annual cash dividend of 4% on the invested capital, in case the 8% hurdle rate is reached. Investors not interested in such a dividend can opt to receive the economic equivalent of the cash dividend as additional participation certificates.

Conclusion & Next Steps

Interested or frustrated?

If you have read all the way to this part, you are either seriously irritated having spent so much time on something that is not for you (then maybe go to our Link list with additional references on private banking or check the books which formed the basis of our investment approach) …

Happy to talk

– or you would seriously consider becoming a co-investor with us in the BVIP. If the latter applies, you are both encouraged to go through the additional fine print (see Legal & Technicalities or Fees) and in particular to get in touch with the members of our team to have a chat on what could be done next.

First step

We would be delighted to welcome you on our joint investment journey for the next 10, 20 or hopefully 30 years … if you are looking at a shorter-term horizon read more just below on our cash managing product called AI-CDC

Accruing Interest - Cash Deposit Certificates

A very simple investment

If you are interested in the AIC-DC product you have simply to fill in a straightforward subscription form. The terms are again very simple: you can withdraw any amount invested at the end of each calendar month. There is absolutely no restriction and no penalty interest if you withdraw the money. Any bonus interest earned by you will be fully paid out to you with no questions asked whatsoever.

Short-term (one month)

Invested money is available on very short notice, i.e. at the end of each calendar month.

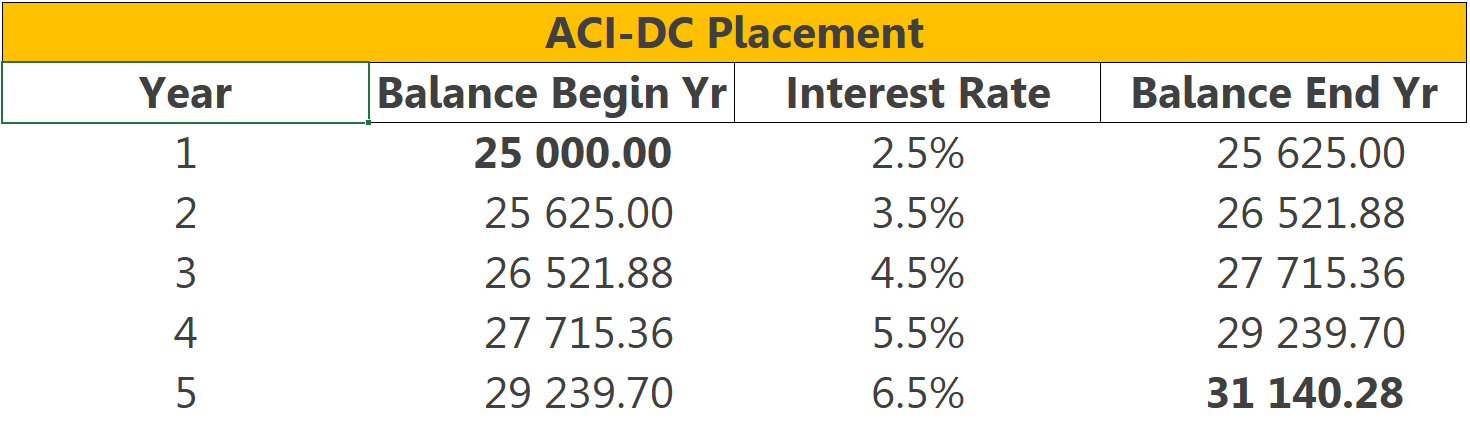

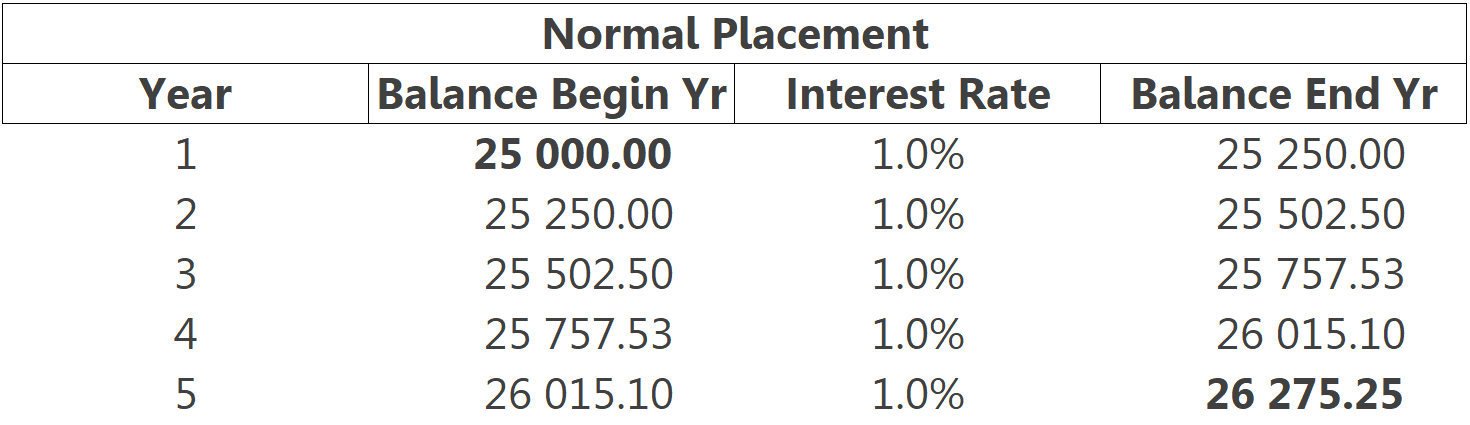

Accumulated bonus

For each year the money stays with us, you receive a 1% bonus interest. Example:

Giving you 20% more over five years

Creating an economic basis for better cash yields

Notably in the current environment of broadly negative interest rates on cash deposits, you are right to wonder how can we be in our right mind to look for ways to create better returns for liquidity deposits. The answer is actually as straightforward as it is surprising: because cash deposits generate (and have always generated) healthy returns. Those returns do however not accrue to the depositors - but almost entirely to the financial institutions who hold those deposits. The simple reason being that although the cash in individual client accounts may fluctuate wildly, in aggregate the banking system keeps billions of deposited cash on a permanent basis - lending it on for an interest rate much, much higher than the one they are paying (on current accounts typically nothing).

Making money like the banks, but sharing it with investors

The Accruing Interest - Cash Deposit Certificates have a similar economic pattern to the one just described above - however, we share the spoils with you much more evenly - and the longer the cash stays with us, the more you get out of it, too. Which is the way it is supposed to be. So you'll ask how does this work?

AI-CDC structure

First, any cash committed is directly paid into dedicated accounts with TD Bank Group, headquartered in Toronto, Canada, with more than 80,000 employees in offices around the world (see www.td.com for more information). Bernstein Trust issues then a certificate of deposit to you giving you a direct legal claim on your pro-rated share of that account, i.e. you are a part-owner in economic terms. The cash is then put to work by us, allowing to build of highly-liquid, highly rated securities with better yields than mere cash, as collateral. Deposits can be made either in USD or EUR. The initial duration can be from one month to 12 months. As is often the case, when the initial duration is over, the cash can be reinvested. Contrary to what banks would do, you don't start again from scratch with the AI-CDC but rather get a bonus interest for each additional 6-month period, hence the term "Accruing Interest".

Learn more

For more information and full documentation on our Accruing Interest - Cash Deposit Certificates please refer to the full investment profile with the links shown below … The entire subscription process of the AI-CDC can be handled online

Any further questions - please contact us

More on: