Proven, fundamental investment strategies with value adding modernization and yield enhancing features.

The Ten Commandments for the Intelligent Investor in the 21st Century

Speed reading

The Basics

There are proven, fundamental investment strategies that have worked well in the past and will work well in the future; in that sense there is no need to reinvent the wheel. Our value added are the modernization and yield enhancing features of these strategies. All this is condensed into the following “10 commandments”.

Results

There are always ups and downs in any market area, usually unpredictable short-term but controllable long-term. History and our own performance have proven that investing in high quality, attractively valued equity and bond markets combined with income-oriented derivatives components should consistently outperform applicable benchmarks.

Advice

Brokerages, their analysts as well as full-fee fund managers and private bankers have no incentive (given that they all live off your fees) to get you into low-cost, long-term investments. The ten principles presented below allow you just that, either by applying them yourself or by investing with us in the Bernstein Value & Income Portfolio.

Introduction

- None of the subsequent principles are in themselves new or particularly original. The fundamental approach was already developed by Benjamin Graham in his game-changing book „The Intelligent Investor”[1], first published in 1949.

- One of the disciples of Graham, Warren Buffett that is, has adapted those principles over the next decades and applied them with extreme success at his investment vehicle Berkshire Hathaway, becoming one of the richest men in the world this way.

- The team of Bernstein Trust & Capital Services OÜ has further modernized the approach, adding more dynamic, yield-enhancing features and successfully adopted it in its own investments. Since 2009, the returns in each year have comfortably exceeded 10%.

- We have condensed the resulting investment principles in the following commandments for the intelligent investor for the 21st century:

[1] http://webcontent.harpercollins.com/text/excerpts/pdf/0060583282.pdf

The Ten Commandments for the Intelligent Investor in the 21st Century

I. Capital protection and eventual full return is the highest priority

- You want to get all your money back and then some.

- A 50% loss requires a subsequent 100% return to recover.

- Don’t concern yourself with temporary price fluctuations, though. A solid investment will eventually come back.

II. Investing has always a long-term focus and is a continuous, disciplined process

- If you trade and speculate short-term be assured to lose most of your money long-term. Investing requires at least a ten year time horizon.

- If you are a pessimist and convinced the world will go under anytime soon, it makes no sense to invest – it would be much wiser to consume whatever spare cash you got.

- Whatever an investment is worth to you should not be determined by temporary market price movements. Rather invest the same amount each and every month. When prices are low you get more "bang for your buck", when price are high they may go higher. In the long-run, by investing regularly and in fixed amounts, you average yourself nicely into the market by buying regular.

III. Market fluctuations are an unavoidable fact of life, nobody can predict them with any level of certainty

- It would be a mistake to base your decisions on the screaming crowd of market and stock pundits, Wall Street analysts or TV hosts.

- None of them has any better ability to predict the market than you. Any money paid to them is wasted.

IV. The purchase of shares in solid, profitable companies with understandable business models offers the highest expected return and best inflation protection

- Basic products and services will always be needed. People will continue to like eating chocolate, going to the movies, taking a vacation, drinking beer, building and upgrading houses, renting cars, having new glasses, … This applies in particular to the new emerging middle class in the yet less industrialized countries.

- New technologies are much more likely to become obsolete, being completely replaced by even “newer” technologies.

- A long history of growing profits and attention to shareholders, amongst others by paying dividends, are clear indicators of companies that will also do well in the future.

- Any inflationary environment will increase the value of the real assets held by a company and decrease the relative value of its fixed-rate liabilities. Solid companies with products that will continue to be in demand are able to increase prices in line with inflation rates. No other asset class offers these combined benefits to protect against inflation.

V. Higher yielding bonds are a useful component of a portfolio

- That statement is particularly true during times of high real interest rates, i.e. when the nominal yield on a bond comfortably exceeds the rate of inflation.

- When real interest rates are low or negative as in many instances right now, bonds should be avoided like the plague.

VI. Hedge against a relative devaluation of your home currency

- Your primary currency can and will fluctuate against a basket of other currencies and other value benchmarks, in particular gold and real estate. There are ways to address this with ease.

- Investing in gold itself makes no sense, since it does not generate anything in terms of income. A better approach is to invest a smaller part of the portfolio in solid, well-capitalized gold mining stocks. They make money on the exploration of gold, pay dividends and their value will increase even more when the gold price goes up, given their reserves in the ground.

- Shares and bonds denominated in currencies other than your home currency provide the trick at no cost. In addition, this provides the overall benefits of portfolio diversification.

VII. The individual selection of stocks has limited chances of success

- In most cases, stock picking generates lower returns than a benchmark index. This applies also to highly-paid so called “active” fund managers. The best overall exposure to good companies can hence be achieved by purchasing low-cost ETFs focusing on market indices both in your home market as well as international markets.

- Individual stock selection should be limited to a few high conviction stocks, e.g. for Warren Buffett that is Coca Cola, Wells Fargo and American Express, which you see like a business owner and would like to own essentially forever …

VIII. High transaction and administration fees are poison for the yield of any portfolio

- Such costs are in many cases transparent and could be cut by using e.g. low cost brokerages, cheaper custodians and better foreign exchange providers. Very often the costs are hidden in cascade-like structures, e.g. funds-of-funds, co-investment vehicles etc. A proper analysis and subsequent avoidance of these comfortably improves net performance.

- Taxes on income and capital gains are equally costs. Any investment strategy and set-up should actively consider this effect. At the same time, potential tax savings should never outweigh a fundamental analysis of the benefits of the investment.

IX. The beneficial use of derivatives is frequently avoided due to sheer ignorance

- Criticism of derivatives is one of the cornerstones of anti-capitalistic rhetoric and market crash articles in the financial press. This is almost 100% due to a complete lack of understanding.

- The smart and controlled use of derivatives can significantly reduce the purchase price of securities, provide income in direction-less markets and provide a downside-cushion in falling markets. Any portfolio manager who is either intellectually or legally prohibited from using derivatives is at a clear disadvantage.

X. Believe in the power of compounding and no investment is too small

- An investment with a yield of 10% doubles in about 8 years, with a 5% annual yield it takes 15 years and a 2% yield a lifetime of 35 years.

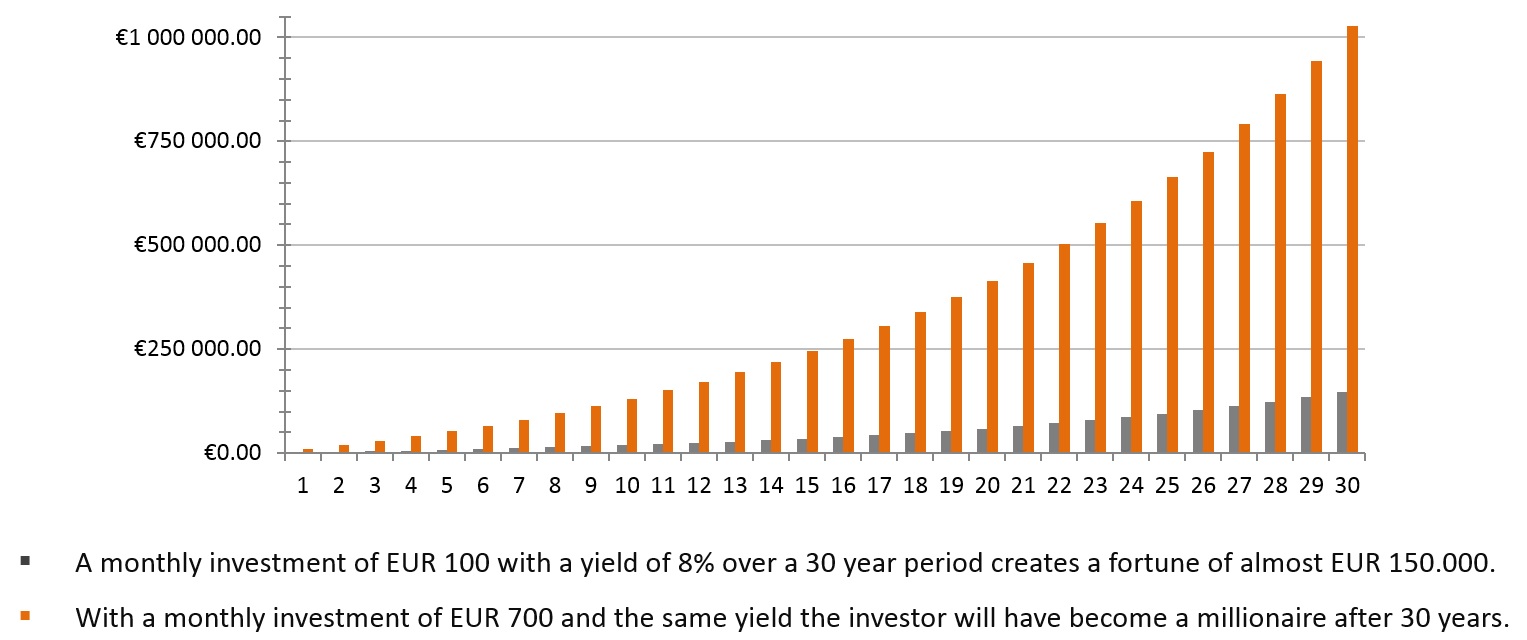

- A monthly investment of EUR 100 with a yield of 8% over a 30 year period creates a fortune of almost EUR 150.000. With a monthly investment of EUR 700 and the same yield the investor will have become a millionaire after 30 years.

- All of the above shows the power of compounding, i.e. the yield on reinvested returns, as well as the accruing benefits of regular, comparatively small investments.

Conclusion

- In our view the principles presented here are general, fundamental and time-tested guidelines for investing. Most market participants however like to disregard them, as they simply do not further their business interests.

- Professional money managers like to tell you – for a fee – how and where to allocate your money and come up with any type of pie-chart either manually – or the newest trend – automatically to select between cash, bonds, shares or other investment product they like to peddle.

- Wall Street analysts and brokerages make money by convincing you to buy a wide variety of ever changing individual stocks and trade in and out of them as often as you can – commissions and fees for them are assured.

- Private banks and active fund managers tell you investing is difficult and charge steep fees for managing your money. Frequently, they follow the herd, triggering buying when the market is high and selling when the market is low.

- Bernstein had also its shares of failures in some of its investment decisions, but sticking to the principles has helped to more than compensate those.

You are on page

The Ten Commandments for the Intelligent Investor in the 21st Century