Just to put the record straight. We did not attend the meeting in person. But thanks to Yahoo Finance we were able to get ample coverage in real time.

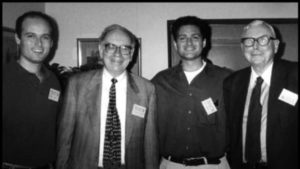

Mr. Buffett and Mr. Munger are smart people, I mean very smart people. They started the lengthy Q&A session slow. I thought, gosh, these guys are getting old. But eventually they moved into a very good flow. I particularly appreciated the dry humor of Mr. Munger.

In essence the two gentlemen did not provide any additional insights in terms of “hot” information. They stuck to the party line, so to speak. Both are extremely rich - and they can simply rest quietly on their laurels of having built Berkshire into a half a trillion cash juggernaut. Obviously, the outside world believes that their > 100 bn USD cash pile is burning a hole in their pockets. I do not believe that. In fact, they are like vultures. They are happy to wait for big opportunities which may happen only every five or ten years, like the 2008/09 financial crisis. They are also bottom fishers. They hate to buy assets at exuberantly high prices. They rather wait for the next panic to use their cash when everybody else is short on it. I love these gentlemen.

They are different – and they want to be different. Also, their investment and partnership philosophy is different. They did not spare on stinging criticism of the private equity world and institutional investments overall. What was extremely insightful – also from the perspective of the Bernstein Value & Income Portfolio – is the way Mr. Buffett described the origins of Berkshire. It happened when some of his family members asked him to manage their money in the 1950s. He certainly felt the burden of managing and safeguarding the capital of those closest to him. On the other hand, he made it very clear that it was more important for him that his relatives accepted the way he wanted to handle the money. If any time the market goes south or a quarter is negative people would start panicking, he wanted none of it. If anybody entrusted him with their money, it was important to take a long-term view. And long-term means ten years and beyond. At the same time, he particularly stressed the extreme responsibility he feels for his investors and protecting their investments. This was evidenced by his answer to the question why Berkshire doesn’t simply invest a major part of its spare cash in low-cost index ETFs. Mr. Buffett’s answer: as quite a few Berkshire investors have already leveraged their full net worth into Berkshire, they need to have a significant security buffer on the level of the company itself.

This philosophy is exactly what Bernstein is about. Like Mr. Buffett and Mr. Munger, we have the most significant part of our net worth co-invested with the fund. Like the two we see capital protection as the first and most important priority. Further, we believe in the long-term prospects of equity investments in great companies at reasonable prices - providing superior returns and allowing for the power of compounding. Lastly, we see our investors as partners with whom we want to do business for a very long time to come, ideally forever.

Overall, it was extremely entertaining and rewarding to listen to these two godfathers of investing and we at Bernstein wish them many happy healthy years at the helm of Berkshire Hathaway.

***

Having said this, they need to make major investments into “elephants” as they call it. We may have some ideas for them, but that is for another blog (in the near future).