You have come a long way - let's make it happen!

How to Invest - Doing it

We just need a few more steps to get you going …

5

Communication is key

Thank you for registering and becoming a member of the Bernstein investor community!

6

Choose the best option

Again: we are long-term investors. In our belief this is the only way to be ultimately very successful. As such, please select between two basic options: 1) invest a fixed amount every month (> USD/EUR 250) or 2) spread out a larger initial investment amount (> USD/EUR 10.000) over a period of 24 months

8

Subscribe & we deliver

Read more about the benefits of a steady, long-term investment strategy….

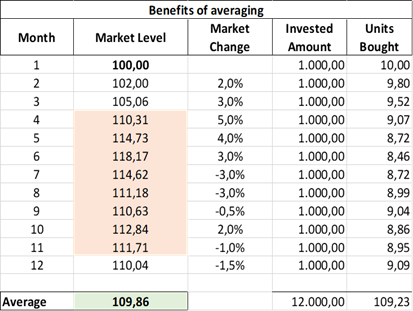

Steady monthly investments

Remember our favorite example: if you invest USD 700 per month getting our targeted 8% annual yield for 30 years you have become a millionaire! By investing steadily ignoring the unavoidable and frequently irrational market swings you achieve the additional benefits of the so-called "averaging". This means by investing the same amount every month you buy more assets when they are cheap, which is good. Buying low is a key to above average returns. More specifically: you do not just pick one date to buy, which you never know is a good or a bad moment. The following example shows: in nine out of twelve months you would have ended with a loss in that particular year - by averaging you still generate positive returns!

Averaging

Compounding - short-term not relevant

Over a short period of time the ratio between the money you actually paid in as an investment and interest earned is high. Therefore principal protection is the key priority. If your principal goes down 25% you need an annualized yield of 5.92% over five years simply to break even.

Compounding - long-term - very relevant

If your investment horizon extends significantly beyond five years and we are talking about a continuous saving and investment process until retirement, the ratio between principal returned and accrued yields is much lower. And this ratio is simply influenced and further improved a) by the expected implied yield of your investments and b) the associated costs related thereto. In this area we offer significant advantages and benefits which we are happy to share with you during the next step...